Budget 2021: Furlough scheme extension and additional grants announced

Budget 2021: Furlough scheme extension and additional grants announced With messages of the economy recovering over time, The Chancellor of the Exchequer

Budget 2021: Furlough scheme extension and additional grants announced With messages of the economy recovering over time, The Chancellor of the Exchequer

IR35 off-payroll working rules From 6 April 2021 off-payroll working rules and how they apply will change. All public authorities and medium

New VAT deferral payment scheme HMRC has announced that businesses that deferred VAT payments between 20 March 2020 and 30 June 2020

Payroll services for small businesses For many businesses, especially small to medium sized businesses, resources can be limited impacting on time to

Businesses employing EU citizens Now that we have come to the end of the Brexit transition period (31 December 2020), business owners

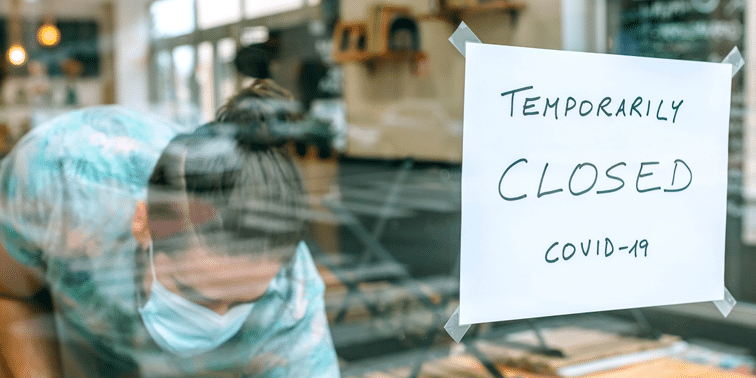

New lockdown grants to support businesses The Chancellor of the Exchequer has announced new grants to support businesses in retail, hospitality and

Additional grant for pubs With many pubs affected by the new tier 2 and 3 rules, the government has announced an additional

[vc_row][vc_column][vc_column_text] £2.2 billion government funding to support local businesses [/vc_column_text][vc_empty_space height=”20px”][vc_column_text] As the government are supporting employees suffering due to COVID-19, it

[vc_row][vc_column][vc_column_text] Government extends Furlough scheme [/vc_column_text][vc_empty_space height=”20px”][vc_column_text] Chancellor Rishi Sunak announced further measures to increase benefits for workers until March 2021. Furlough Scheme extension

[vc_row][vc_column][vc_column_text] Job Retention Scheme extended to December [/vc_column_text][vc_empty_space height=”20px”][vc_column_text] With the impending lockdown 2.0, the government has announced that the Furlough Scheme is