Omicron: £1billion in support for businesses

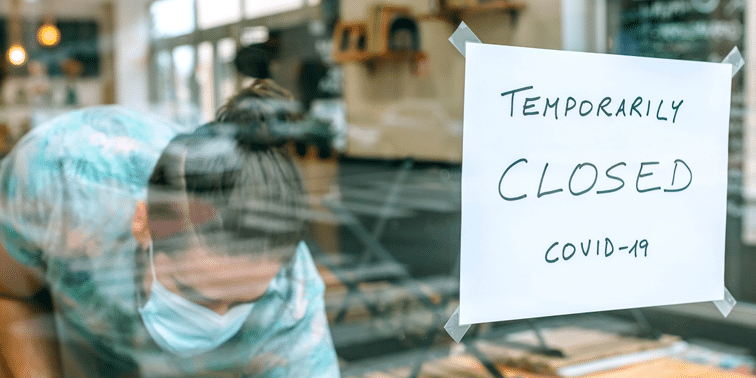

Omicron: £1billion in support for businesses The Chancellor of the Exchequer, Rishi Sunak announced on 21 December 2021 that £1billion additional support

Omicron: £1billion in support for businesses The Chancellor of the Exchequer, Rishi Sunak announced on 21 December 2021 that £1billion additional support

Temporary 5% reduced rate of VAT ends 30 September 2021 From 30 September 2021 the 5% reduced rate of VAT for certain

Tax relief claims for working from home HM Revenue and Customs (HMRC) has announced it is accepting tax relief claims for working

[vc_row][vc_column][vc_column_text] COVID-19 BUSINESS SUPPORT RESOURCES HMRC has compiled a summary of all the support measures for UK businesses as part of its

Prepare for grant changes from 1 July 2021 As per the budget announcement earlier in March, the Furlough Scheme is extended until

Budget 2021: Furlough scheme extension and additional grants announced With messages of the economy recovering over time, The Chancellor of the Exchequer

New VAT deferral payment scheme HMRC has announced that businesses that deferred VAT payments between 20 March 2020 and 30 June 2020

Supreme Court backs business interruption insurance claims Policyholders with business interruption insurance facing disputed claims could now be seeing their insurer pay

New lockdown grants to support businesses The Chancellor of the Exchequer has announced new grants to support businesses in retail, hospitality and

Government furlough and loan schemes extended The Chancellor of the Exchequer has announced that the furlough Scheme will be extended until 30