Real Living Wage rises to £9.90 an hour

Real Living Wage rises to £9.90 an hour The Real Living Wage, an independent calculation made according to the cost of living,

Real Living Wage rises to £9.90 an hour The Real Living Wage, an independent calculation made according to the cost of living,

How to grow your business Starting a business is no small feat. It can be incredibly difficult to keep up with all

Budget October 2021 The Chancellor of the Exchequer, Rishi Sunak, has today announced the Budget and Spending Review to a packed Houses

What is tax compliance? In a nutshell, tax compliance is about ensuring the correct amount of tax is being paid whether you

Temporary 5% reduced rate of VAT ends 30 September 2021 From 30 September 2021 the 5% reduced rate of VAT for certain

1.2% Increase to National Insurance Contributions From April 2022,National Insurance Contributions (NICs) are set to rise by 1.25% to cater for a

Construction accounting basics All contractors must register for the Construction Industry Scheme (CIS). The HM Revenue and Customs (HMRC) scheme means that

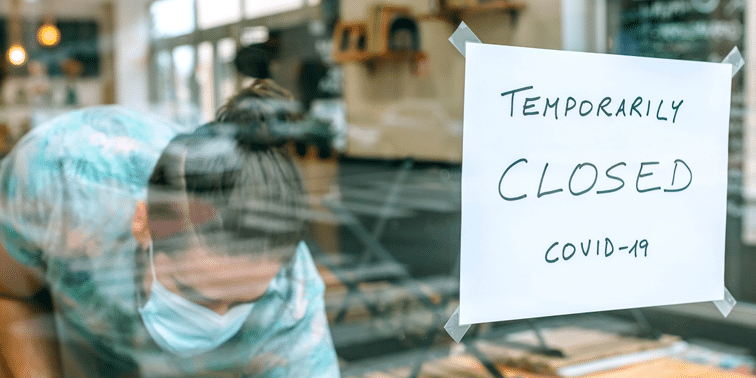

Tips for business start-ups With COVID-19 impacting us all, many found that their job roles changed or were furloughed. As we found

Prepare for grant changes from 1 July 2021 As per the budget announcement earlier in March, the Furlough Scheme is extended until

Budget 2021: Income tax and Corporation tax updates Whilst huge focus on the effects of COVID-19 on the economy is evident in